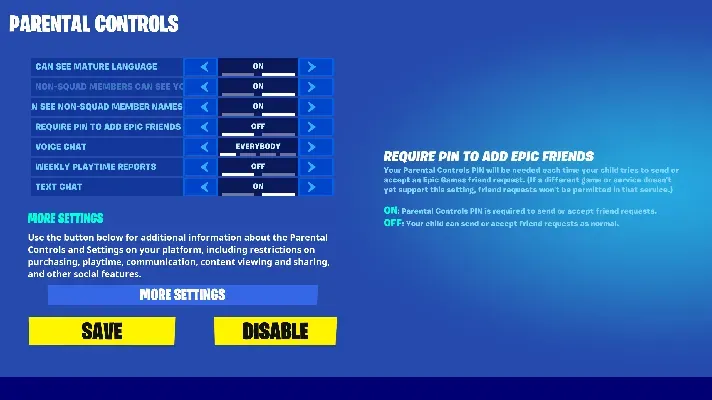

Parental controls for gaming expenses have become an essential topic for families navigating the complexities of modern gaming. With the rise of microtransactions in gaming, many children are unknowingly racking up significant charges on their parents’ credit cards. Tools like the Lootlock app offer solutions for effective gaming expense management by enabling parents to preload a digital debit card that their kids can use for in-game purchases, all while promoting financial education for kids. Such innovations not only protect against unexpected bills but also guide children in understanding their spending habits within the gaming world. As the gaming landscape evolves, ensuring that children’s spending in games is monitored has never been more critical for parents seeking to foster responsible habits.

When it comes to overseeing children’s finances during gaming, the introduction of effective budget controls is imperative. With gaming becoming increasingly intertwined with real-world financial decisions, many parents are looking for ways to manage their children’s expenditure safely. Innovative solutions like Lootlock help streamline oversight of in-game purchases and provide an approachable platform for young gamers to learn valuable financial skills. As video games continue embracing payment options like microtransactions, developing an understanding of financial health is crucial for both kids and parents. By implementing controls to monitor and limit spending, families can create a balanced gaming experience that prioritizes enjoyment while safeguarding against unnecessary financial strain.

Understanding the Need for Parental Controls in Gaming Expenses

In today’s digital age, children are exposed to various gaming platforms where in-app purchases and microtransactions are prevalent. This has resulted in a significant increase in unauthorized gaming charges which can lead to massive debts for parents. According to the Consumer Financial Protection Bureau, children often fall prey to the enticing design tricks implemented by gaming companies, resulting in chronic overspending on virtual items. Parental control measures have become essential as they directly address these concerns by allowing parents to manage and monitor their children’s spending habits more effectively.

With the rise of gaming expenses and the staggering figures cited regarding the millions of dollars lost to unauthorized purchases, it’s crucial for parents to understand how financial education can also play a role. By implementing parental controls combined with educational tools, parents can instill responsible spending habits in their children. Apps like Lootlock not only provide safeguards against excessive spending but also empower parents to introduce their kids to financial literacy, helping them navigate the complexities of children’s spending in games.

Lootlock: A Solution to Gaming Expense Management

Lootlock has emerged as a viable solution in the landscape of gaming expense management. By allowing parents to preload a prepaid credit card that restricts purchases to gaming-related expenses, Lootlock alleviates worries parents may have about their children making unauthorized purchases. This system not only safeguards their finances but also adds a layer of control over kids’ digital spending, ensuring parents can monitor what their kids are buying without causing friction in their gaming experiences.

Furthermore, Lootlock integrates gamified elements into financial management, teaching children the importance of responsible spending. With features like ‘bounty boards’ that reward kids for completing chores, this app provides a unique approach to managing their gaming budgets. This combination of fun and learning can lead to better financial understanding for kids, making them more aware of financial decisions as they grow up. By showcasing its potential at platforms like TechCrunch Disrupt, Lootlock aims to revolutionize how families handle gaming expenses.

The Impact of Microtransactions on Children’s Spending Habits

Microtransactions have significantly impacted how children interact with gaming. These small, seemingly harmless payments can add up quickly, often leading to substantial bills without the child’s awareness or consent. The prevalence of these in-game purchases can cause emotional and financial strain on families, especially when children are unaware of the consequences of their spending behavior. As the gaming industry continues to thrive on this model, parents must take proactive measures to ensure their kids understand the implications of their purchases.

With the rise of microtransactions, the gaming industry has faced scrutiny from various consumer protection agencies, emphasizing the need for greater accountability. Thankfully, apps like Lootlock are stepping up to safeguard against these hidden costs. By fostering a culture of financial education that highlights the importance of budgeting and controlled spending, parents can guide their children toward healthier gaming habits. This ensures that kids not only enjoy gaming responsibly but also learn valuable lessons about managing their money in a digital world.

Gamification and Financial Education for Kids

Gamification is swiftly becoming a powerful tool in children’s financial education, with applications designed to make learning about money fun and engaging. By incorporating game-like elements into the teaching process, children can better grasp complex financial concepts in an interactive manner. Programs that reward children for completing tasks, such as the ‘bounty boards’ feature in Lootlock, allow kids to earn money through chore completion tied to their gaming experiences, promoting a sense of responsibility and achievement.

Moreover, children who engage with financial concepts through gamification are more likely to retain the lessons they learn. By using avatars and virtual rewards as incentives, children develop a keen sense of budget management, understanding the consequences of their spending behaviors. As they select items for their avatars or monitor their spending on “Lootlock dashboards”, they gain hands-on experience with managing their finances, equipping them for future financial responsibilities.

Creating Safe Gaming Environments with Lootlock

Creating a safe gaming environment for children is a priority for many parents, especially with the risks associated with in-game purchases. Lootlock stands out as an innovative solution by providing tools that not only monitor spending but also enhance the gaming experience. This dynamic approach encourages children to engage in responsible spending practices while keeping gaming fun and exciting. With protections in place, parents can feel more secure knowing their children can explore gaming without the fear of excessive financial burden.

The security measures implemented by apps like Lootlock enhance the overall enjoyment of gaming for both parents and children. By restricting purchases to predetermined budgets and promoting awareness of spending, parents can instill healthy financial habits early on. This dual benefit of secured gaming combined with financial education ensures that children are not only entertained but are also learning valuable lessons that will serve them well into adulthood.

Empowering Parents with Tools for Expense Control

As gaming continues to evolve, parents are increasingly seeking tools to empower their control over their children’s gaming expenses. Apps like Lootlock offer invaluable features to manage allowances and spending, enabling parents to set limits and monitor gaming expenditures. This level of oversight bridges the gap between children’s desire to explore new games and the necessity to maintain financial responsibility, forging a healthier relationship with digital spending.

By equipping parents with methods to preload cards and adjust allowances based on conditions, Lootlock allows for a tailored approach to managing children’s spending in games. This capability not only helps prevent financial mishaps but also opens up opportunities for learning conversations about budgeting and financial responsibility. Parents can feel confident in giving their children a degree of autonomy within safe parameters while reinforcing the importance of making sound financial choices.

The Role of Financial Education in Responsible Gaming

Financial education plays a crucial role in ensuring responsible gaming habits are developed from an early age. With digital platforms becoming increasingly integral to children’s lives, integrating financial teachings into their everyday experiences is essential. Lootlock fosters this education by gamifying financial concepts, allowing children to learn about spending and budgeting in a context they find engaging. This significant shift towards incorporating fiscal knowledge into gaming can lead to better-informed decision-makers down the line.

By using interactive tools and features that reward smart spending habits, kids develop a stronger understanding of the value of money. As they navigate their gaming experience through Lootlock, they also gain insights into the financial implications of microtransactions and in-game spending. This dual learning approach reinforces not only gameplay but also pivotal financial principles, preparing them for a future where money management skills are increasingly vital.

Preparing for TechCrunch Disrupt: Showcasing Innovations in Gaming Parental Control

TechCrunch Disrupt has become a launching pad for innovative solutions targeting modern challenges, and Lootlock is poised to make a significant impact there. By participating in such a high-profile event, Lootlock aims to shed light on the urgent need for enhanced parental controls concerning gaming expenses. The platform serves not only to showcase their product but also to ignite discussions about responsible gaming and childhood financial literacy in the tech community.

As the founder, Nick Pompa, shares insights on the pressing issues around children’s spending in games, he joins a broader conversation on how technology can better serve families. Lootlock’s appearance at TechCrunch highlights the intersection of technology, gaming, and financial responsibility, encouraging innovators and parents alike to consider the implications of children’s interactions with money in gaming. Their goal is to establish a standard where responsible gaming is intertwined with financial education, ensuring a generation of savvy consumers moving forward.

The Future of Gaming and Financial Responsibility

The future of gaming is undoubtedly tied to financial responsibility, especially as microtransactions and in-game purchases continue to dominate the market. As parents, it’s essential to advocate for models that protect children from excessive spending while fostering their enjoyment of gaming. The integration of financial education within gaming applications, as showcased by Lootlock, signifies a positive trend toward responsible gaming practices that align with children’s interests.

As the digital landscape expands, embracing tools that empower both parents and children in managing gaming expenses will become ever important. Encouraging kids to learn about finances through gaming while simultaneously practicing self-control will prepare them for a successful financial future. With solutions like Lootlock paving the way, the responsibility of instilling sound financial habits will move from a challenge to a collaborative journey between parents and their children.

Frequently Asked Questions

How can parental controls for gaming expenses help manage children’s spending in games?

Parental controls for gaming expenses, such as those offered by the Lootlock app, enable parents to set limits on their children’s spending. This allows parents to preload a digital prepaid card, automate allowances, and restrict purchases to gaming-related products. By doing so, parents can effectively manage their children’s spending habits in games, ensuring financial education while protecting their finances from unauthorized charges.

What features does Lootlock offer to prevent microtransactions in gaming for kids?

The Lootlock app provides features specifically designed to prevent unauthorized microtransactions in gaming. It allows parents to fund a prepaid card for their children, control the amount available for game spending, and approve increased spending through text notifications. Additionally, Lootlock gamifies the process by linking spending with the completion of household chores, encouraging children to engage in financial responsibility.

Why is financial education for kids important in relation to gaming expenses?

Financial education for kids is essential, particularly in light of the increasing trend of microtransactions in gaming. Teaching children about budgeting and responsible spending through parental controls and apps like Lootlock helps them understand the value of money. It lays the foundation for lifelong financial literacy, ensuring children become aware of their spending habits and the implications of in-game purchases.

Are there any best practices for parents to implement gaming expense management?

When managing children’s gaming expenses, parents should consider employing parental controls that limit in-app purchases, such as those offered by Lootlock. Additionally, setting a clear allowance structure, discussing the need for financial responsibility, and gamifying chores can reinforce healthy spending habits. Regular communication with children about gaming expenses and the importance of budgeting is also crucial.

How does Lootlock gamify financial education for children regarding gaming purchases?

Lootlock gamifies financial education by incorporating game-like elements into its spending management system. Children can earn points by completing chores linked to their gaming expenses, which they can then use to upgrade their avatars within the app. This interactive approach not only makes learning about finances fun but also teaches them responsible spending habits in real-time within the gaming environment.

What are the risks of not using parental controls for children’s spending in games?

Without parental controls for children’s spending in games, parents risk facing unexpected charges on their credit cards from unauthorized purchases, often reaching significant amounts. Children may unknowingly fall into traps set by gaming companies that encourage impulse spending. This lack of oversight can lead to financial strain and contribute to poor financial habits in the long term.

How can parents monitor their children’s spending in games effectively?

Parents can effectively monitor their children’s spending in games by using dedicated apps like Lootlock, which provide transparent tracking of expenditures. These apps allow parents to set limits, receive alerts for transactions, and even implement conditions for unlocking additional funds. Establishing open communication about gaming expenses alongside real-time monitoring helps maintain financial awareness.

What is the significance of TechCrunch Disrupt for fintech innovations like Lootlock?

TechCrunch Disrupt serves as a pivotal platform for fintech innovations such as Lootlock, providing visibility to startups focused on financial education and expense management for kids. It allows entrepreneurs to showcase their products, network with industry experts, and gain insights into market trends. Participation in such events can drive growth and highlight the importance of safeguarding children’s financial health in the gaming space.