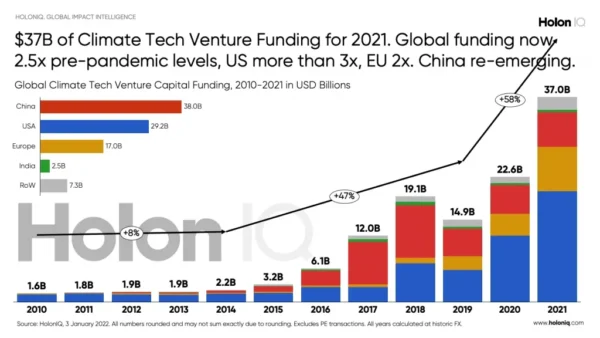

Climate tech funding is emerging as a crucial linchpin in the global effort to combat climate change and transition to sustainable energy solutions. These ventures often face what’s known as the “valley of death,” a challenging period where innovative startups struggle to secure the substantial capital needed to scale their groundbreaking technologies. As these companies often focus on hardware solutions, the scaling demands become significantly higher, necessitating tens or even hundreds of millions in investment. To address this pressing concern, initiatives like the All Aboard Coalition are stepping in, aiming to raise substantial funds to support these critical climate technologies. By facilitating access to venture capital and igniting startup investment, climate tech funding could very well unlock solutions that promote a greener, more sustainable future.

In the realm of environmental innovation, financing for eco-friendly technology startups has become paramount in ensuring early-stage companies can thrive. This type of financing is crucial as it helps bridge the often perilous gap—commonly known as the “valley of death”—that many ventures face as they seek to transform their prototypes into scalable products. The All Aboard Coalition exemplifies efforts to enhance support systems for climate startups, targeting substantial investments aimed specifically at sustainable projects. By focusing on venture capital rather than traditional financing routes, this initiative fosters a network of support that empowers these organizations to flourish. As global awareness of climate change intensifies, nurturing these emerging technologies through dedicated funding sources stands out as a strategic imperative for both investors and the planet.

Understanding the Valley of Death in Climate Tech Startups

The ‘valley of death’ is a critical phase in the lifecycle of climate tech startups that highlights the gap between initial funding and the substantial growth capital needed to scale proven technologies. This unique challenge is particularly pronounced for companies focused on hardware solutions, where physical innovations necessitate significant financial investment. For instance, building first-of-their-kind power plants or manufacturing facilities requires hundreds of millions of dollars, making it imperative for founders to navigate this gap effectively.

Startups often find themselves in a precarious situation when transitioning from early-stage funding to larger capital rounds. This phenomenon, common across many sectors, poses a particularly steep challenge in climate technology, where investors need to be convinced of both the feasibility and market potential of groundbreaking inventions. Without addressing this valley of death, promising climate solutions risk stagnation and failure long before they can contribute to sustainability goals.

The Role of All Aboard Coalition in Climate Tech Funding

The All Aboard Coalition emerges as a pivotal player in addressing the financing challenges faced by climate tech startups. By aiming to raise $300 million in the upcoming months, the coalition is uniquely focused on bridging the ‘missing middle’ in startup funding, specifically targeting the $100 million to $200 million investment rounds that are crucial for the development of innovative projects. This initiative is essential for enabling climate tech companies to transition from concept to commercial viability.

What sets the All Aboard Coalition apart is its strategic focus on creating a network of seasoned climate tech investors. Spearheaded by Chris Anderson, the coalition seeks not only to invest but also to signal confidence to larger institutional investors in the sector. This network effect is crucial, as it can lead to a domino effect where other notable venture capital firms follow suit, enhancing the overall landscape of climate technology funding.

Venture Capital Strategies for Climate Technology

Venture capital plays a fundamental role in supporting climate technology startups, especially in navigating the complexities of scaling innovative solutions. Unlike traditional project financing, which focuses on specific ventures, the All Aboard Coalition emphasizes equity and convertible equity investments. This strategic focus positions the fund within the venture capital realm, allowing it the flexibility to back companies rather than specific projects, which often have longer gestation periods.

Additionally, the venture capital model is particularly advantageous for climate tech startups seeking agile funding solutions that can adapt as the market evolves. By providing growth capital linked to equity stakes, the All Aboard Coalition encourages innovation while maintaining alignment with the long-term financial health of the industry. This approach not only helps mitigate risks for investors but also fosters the development of sustainable technologies that can keep pace with global climate goals.

The Importance of a Strong Investor Network in Climate Tech

As the climate tech landscape evolves, having a robust network of influential investors is increasingly critical for startups aiming to overcome the ‘valley of death.’ The All Aboard Coalition’s strategy emphasizes the importance of leveraging connections amongst established venture capital firms to instill confidence in potential backers. By having notable partners from various firms involved, new startups can gain credibility, making it easier to attract additional funding.

This network-driven approach encourages seasoned investors to collaborate, sharing insights and capital to amplify their impact in the climate technology sector. With prominent firms backing the coalition, startups can reap the benefits of shared resources and collective expertise, significantly enhancing their chances of presenting compelling business cases to common sources of capital.

Bridging the Funding Gap for Climate Innovations

The funding gap for climate innovations remains a pressing concern as startups move from research and development to commercialization. It’s widely acknowledged that creating breakthrough technologies requires substantial financial backing; however, accessing that capital is often fraught with challenges. The All Aboard Coalition seeks to bridge this gap by specifically targeting investment in climate tech solutions that are at the forefront of innovation, ensuring that high-potential projects receive the necessary resources.

Strategically, this focus on the ‘missing middle’ capital is unprecedented, as traditional funding mechanisms often overlook the crucial investment rounds that can allow startups to fully realize their potential. By concentrating efforts on securing large-scale funding, the coalition not only assists individual companies but also fosters a healthier ecosystem for climate tech investment, inspiring other investors to consider the merits of supporting early-stage growth in a sector poised for significant impact.

Future Prospects for Climate Tech Startups

Looking ahead, the trajectory for climate tech startups is poised for an exciting transformation, primarily driven by initiatives like the All Aboard Coalition. Their commitment to raising significant funds directly addresses the pressing financial needs of startups navigating the challenging phases of funding. The combination of venture capital support and a focus on innovative climate solutions suggests a burgeoning marketplace ripe for investment.

Moreover, as more investors recognize the urgent need for sustainable technologies, the climate tech investment landscape is expected to expand, opening new avenues for startups. This shift could yield a greater influx of generalist investors willing to explore opportunities within the climate sector. As the movement towards sustainability gains momentum, climate tech startups are not just positioned to thrive but could become a cornerstone of future economic growth and environmental stewardship.

Key Players in Climate Tech Investment

The cohesive involvement of key players in climate tech investment is crucial for fostering innovation and driving progress. The subgroup of firms within the All Aboard Coalition—ranging from Ara Partners to Khosla Ventures—represents a diverse array of expertise and strategic focus, meaning that startups can benefit from a wealth of knowledge and resources. This convergence of investment perspectives enhances the potential for groundbreaking advancements in the climate sector.

Having notable firms engaged in the coalition not only boosts credibility but also encourages broader industry participation. When established investors advocate for climate tech, it serves as a clear signal to the market about the viability and urgency of these technologies, leading to increased investor interest. Climate tech startups have the unique opportunity to tap into these networks, amplifying their visibility and accessibility to a broader investor base.

Sustainable Development Goals and Climate Technology

Aligning climate technology development with sustainable development goals is a vital consideration for today’s startups. The All Aboard Coalition aims to channel investments toward projects that directly contribute to global climate targets, showcasing the vital intersection of economic growth and environmental sustainability. This strategic alignment attracts investors not only motivated by financial returns but also by a commitment to impactful change.

In doing so, climate tech startups position themselves as facilitators of the transition towards a more sustainable future, appealing to a growing demographic of socially responsible investors. As the urgency to combat climate change intensifies, the focus will increasingly shift towards technologies that not only promise profitability but also adhere to sustainable practices, creating a cyclical benefit where financial incentives align with planetary needs.

Engaging Generalist Investors in Climate Tech

Engaging generalist investors is essential for securing the broad financial support needed for climate tech startups. The All Aboard Coalition acknowledges that while specialized venture capital can provide initial funding, attracting general investors can significantly amplify growth prospects. This inclusion of generalists not only diversifies the investor base but also enhances the resilience of climate tech funding.

Generalist investors often bring fresh perspectives and additional capital, spurring further innovation and development within the climate tech sector. They also help validate the market potential of climate technologies by increasing the level of interest among diverse funding channels. Successfully onboarding these investors will play a critical role in the long-term sustainability and expansion of climate tech initiatives.

Frequently Asked Questions

What is climate tech funding and why is it important for startups?

Climate tech funding refers to the financial investment aimed at supporting startups and companies that develop technologies to combat climate change. This funding is critical as it helps these startups navigate the ‘valley of death,’ a gap between early seed money and the larger capital required to scale innovative solutions to commercial viability.

How does the ‘valley of death’ affect climate technology startups?

The ‘valley of death’ is a term used to describe the challenges climate technology startups face in securing sufficient funding between initial investments and the larger sums required for growth. Startups in climate tech often focus on hardware so the financial demands can be substantial, potentially reaching hundreds of millions of dollars. Without adequate funding, many startups struggle to bring their innovations to market.

What role does venture capital play in climate tech funding?

Venture capital is crucial in climate tech funding as it provides the significant financial backing needed for startups to develop and commercialize their technologies. Funds like the All Aboard Coalition aim to attract venture capital investments specifically focused on bridging the funding gaps in climate technology, enabling these startups to move beyond the initial funding phases.

What is the All Aboard Coalition and how does it support climate tech funding?

The All Aboard Coalition is a new fund focused on raising $300 million to assist climate tech startups in overcoming the ‘missing middle’ financing gap. By helping startups secure significant funding rounds of $100 million to $200 million, the coalition aims to facilitate the development of first-of-a-kind climate projects, making a substantial impact on the field of climate technology.

How can climate tech startups attract more investment?

To attract more investment, climate tech startups should actively engage with networks of investors and showcase their technologies’ potential for impact. Initiatives like the All Aboard Coalition signal credibility to larger institutional investors, which can help startups gain the necessary backing to thrive. Demonstrating scalability and a clear path to commercial success is also essential.

What challenges do first-of-its-kind climate technology projects face in securing funding?

First-of-its-kind climate technology projects often encounter significant challenges related to funding due to the high capital requirements that can reach tens or hundreds of millions of dollars. The risks associated with untested technologies and the lengthy development timelines can dissuade investors, highlighting the importance of specialized funds like the All Aboard Coalition to bridge these funding gaps.

What is the significance of the network formed by the All Aboard Coalition?

The network established by the All Aboard Coalition is significant because it comprises prominent climate investors who can validate the startups they back. By signaling to larger institutional investors that these climate tech companies are worthy of funding, this network enhances their chances of securing the necessary capital to scale their operations effectively.

What type of investments does the All Aboard Coalition provide to climate tech startups?

The All Aboard Coalition primarily offers equity and convertible equity investments to climate tech startups. Unlike traditional project financing, which often involves loans, this approach positions the coalition firmly within the venture capital space, focusing on long-term growth and profitability for supported technologies.

How does the All Aboard Coalition aim to signal potential investors in the climate tech sector?

The All Aboard Coalition seeks to create a ‘Sequoia-like’ effect in the climate tech sector. By making strategic investments in promising startups, the coalition hopes to attract attention from seasoned funds and prime institutional investors, thereby augmenting the overall confidence and support for climate tech funding.

What is the potential investment amount needed for climate tech startups to succeed?

Climate tech startups may require more than $300 million collectively and even more substantial amounts as they attempt to scale and overcome challenges associated with the ‘valley of death.’ The All Aboard Coalition’s efforts are aimed at securing the $100 million to $200 million funding rounds necessary for transformative projects.

| Key Point | Description |

|---|---|

| Valley of Death | Climate tech startups often face a significant funding gap between initial funding and the capital needed for growth. |

| The Missing Middle | A new fund called the All Aboard Coalition aims to bridge this financing gap by raising $300 million. |

| Funding Requirements | Startups need between $100 million to $200 million for developing first-of-a-kind climate technologies. |

| Network of Investors | The All Aboard Coalition is supported by a network of prominent climate investors to attract larger institutional investors. |

| Leadership | Chris Anderson, former head of TED, leads the coalition and utilizes his expert network to facilitate funding. |

| Investment Strategy | All Aboard focuses on equity investments rather than loans or project finance. |

| Investment Influence | The fund aims to signal to other funds that when it invests, it’s a worthy opportunity, encouraging wider investment. |

| Future Prospects | More than $300 million and extensive engagement from generalist investors will be essential for the climate tech sector. |

Summary

Climate tech funding is crucial for overcoming the significant challenges faced by startups in this sector. The emergence of the All Aboard Coalition highlights a targeted effort to bridge the critical funding gap that typically hinders the commercial growth of innovative climate technologies. By leveraging a powerful network and focusing on substantial investments, the coalition aims to provide a pathway through the ‘valley of death,’ ensuring that pioneering solutions can achieve the scale needed to address pressing climate challenges.